The Question

How do you help a start-up business to achieve rapid growth in the UK finance market?

The Answer

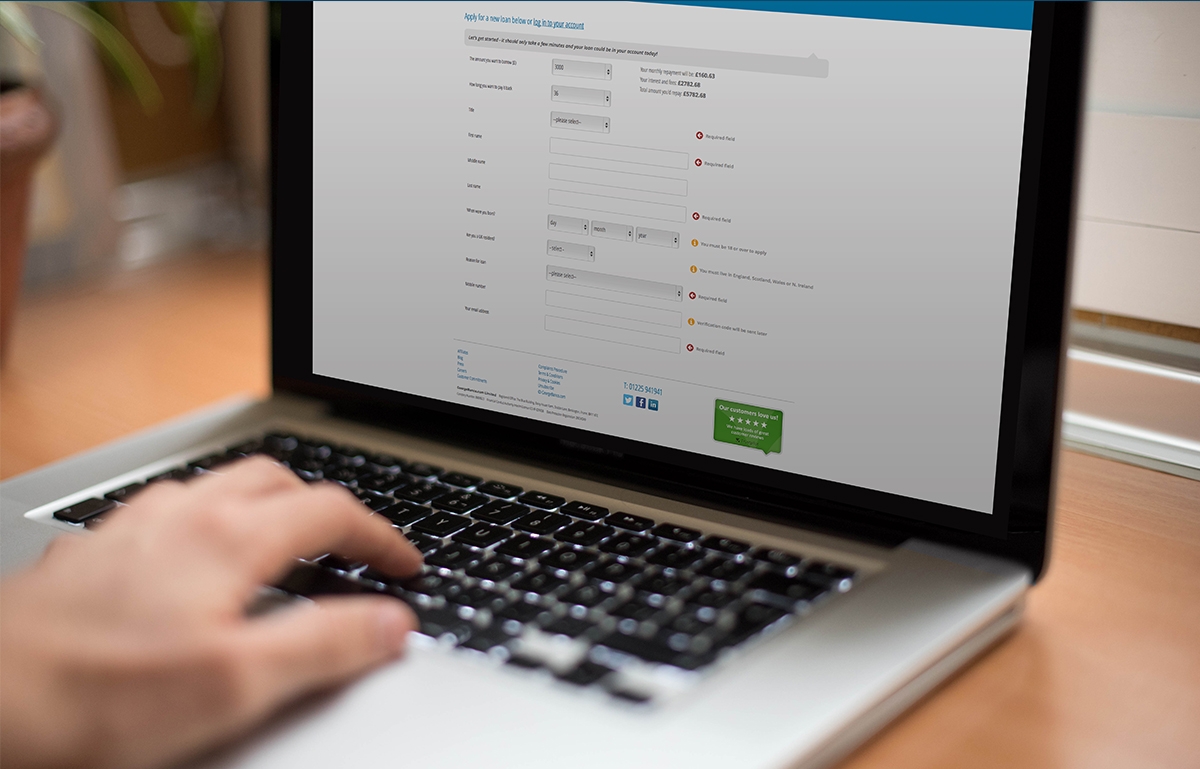

When George Banco launched in the spring of 2014, they provided personal unsecured loans supported by a borrower’s personal guarantor. Access was approached to help the business develop a seamless end-to-end online system that processes loan applications with minimal human intervention.

The team at Access worked in conjunction with George Banco’s founder to develop a site with a unique and intuitive customer journey. Built in Symfony2, an open-source PHP web development framework, the site integrates at multiple points with a loan management software technology platform requiring strict adherence in data integrity. Other third parties include WorldPay integration for processing payments and API callbacks; an SMS service for mobile phone validation; look up services, including postcode, addresses and bank sort codes.

The site utilises Bootstrap Framework to deliver an optimised experience across desktops, laptops, tablets and phones. To ensure complete user satisfaction, the customer journey has been modeled to ensure an easy 7 step loan application process.

Results and Achievements

In the first six months since hard launch (following an initial three month soft launch) the system has handled over half a million enquiries; resulting in 1,000s of loan applications, 1,000s of guarantors added, and an abundance of satisfied customers as demonstrated by George Banco’s ‘Excellent’ Trust Pilot rating. Although numbers since then have grown substantially and their business model continues to evolve, client confidentiality prohibits us from divulging further detail .

George Banco aims to provide personal unsecured loans from £1,000 to £7,500 to UK residents who are excluded from the mainstream lenders. These loans are repayable in fixed monthly installments over terms of 12 to 60 months.